Startups and SMEs face many challenges - make sure you know how to overcome them by exploring our blogs for the latest news and insights across a range of accountancy and legal topics.

- (S)EIS Tax Relief

- Accountancy Best Practice

- Art and Luxury Assets

- Business Immigration

- Commercial Law

- Commercial Litigation

- Corporate Law

- Corporate Strategy

- EMI Share Option Scheme

- ESG Compliance

- Employment Law

- Fundraising Strategy

- Human Resources

- Intellectual Property

- Merger and Acquisition

- NFTs and Digital Trading

- R&D Tax Credits

- Startups & SME Advice

- Tax Advice

- UK Subsidiary

Alternative Dispute Resolution for SMEs

Business disputes are unavoidable and it’s for this reason that Dragon Argent are delighted to introduce our new Head of Commercial Litigation, Margherita Barbagallo and she have shared some thoughts about why she feels it is so important for founders to focus on resolving disputes rather than using the court system.

Important Tax Deadlines for Employers Explained

In this week’s newsletter, Dragon Argent Tax Advisor, Misha Patel have drawn attention to two tax reporting deadlines which are approaching on July 6th 2022. These are employment related securities reporting and P11D reporting. Learn more.

Game Creators: Legal and Practical Considerations

In this week’s newsletter, Dragon Argent covers some key legal and practical considerations for anyone looking to set up an indie game studio (with particular thanks to our new Corporate & Commercial Solicitor Jamie Thornton for providing the expert analysis!).

Investment Round Best Practice

In this week’s newsletter Dragon Argent Commercial Strategy Advisor & Chief Commercial Officer James Taylor had a look at the recent shift in the startup funding landscape that has taken place throughout the first half of 2022. More importantly, we are going to offer some guidance on how founders can insulate themselves from the increasingly challenging environment.

SEIS and EIS Do's and Don'ts for Founders

In this weeks newsletter, the Dragon Argent Corporate & Commercial Solicitor Freddie-Nicolle Brace share her top tips for founders and entrepreneurs when it comes to utilising the SEIS & EIS venture capital schemes.

Does my business need a company secretary?

Dragon Argent look at the circumstances in which a startup might benefit from appointing a company secretary, particularly in respect of enterprise value.

How to manage your business disputes

Starting up a business is an exciting time but you may become embroiled in disputes with clients, suppliers or employees. Find out how to avoid going to court and protect your business from disputes.

How to legally protect your business from Co-founder disputes?

In this week’s newsletter, Dragon Argent corporate lawyers provide advice on how to legally protect your startup business from co-founder disputes or managing the exit of a founder.

Investment Pitch Deck Presentation Template for Startups & SMEs

In this week’s newsletter, Dragon Argent examines some fundamentals of building pitch decks to raise investment. Certainly, for tech-enabled businesses that are capital intensive, raising investment is an essential aspect of scaling the business.

How to Apply for Business Recovery Loan Scheme?

Are you aware that there are just 3 months left to capitalise on potentially transformative government backed finance? Get funding through accredited RLS lenders. No Personal Guarantees for Loans Below £250k.

Workshop Invitation: The Importance of Enterprise Value (EV) and How to Build it

Dragon Argent would like to invite you to attend an online workshop for founders and management teams on "How to Build Enterprise Value".

Is my business eligible for R&D tax credits

Dragon Argent R&D tax specialists provide an end-to-end service that makes claiming R&D tax credits easy for you. The average UK SME R&D claim is worth £32,409* so don't miss out on the chance for a valuable cash injection for your business. How to claim R&D Tax Credits?

How to Build a Culture of Care

In light of International Women’s Day, we would like to share our support for the #CultureofCare campaign launched by Equality Forward, a global consultancy founded by Michelle King dedicated to building workplaces that work for everyone. Learn more.

Dealing with Copyright Infringement

“All my ideas are stolen anyway”, as once said by acclaimed British artist Damien Hirst. We see this time and again – an artist using an existing work, without that original creator’s authorisation, as the basis for their artwork. This is the subject of this week’s newsletter.

The Impact of New Legislation on B2C Business Model

If you have a B2C model, there is a new directive amending consumer legislation that it’s very important to be aware of. This legislation will impact the terms business include in consumer facing agreements like services agreements and terms and conditions. Learn more.

Directors Loan Accounts & How to Use Them

Our specialist accountants for startups look at exactly how a directors loan account functions, what it can help a director to achieve and tax planning opportunities. Learn more

Intellectual Property Essentials for Startups

In this week’s newsletter, Dragon Argent look at some of the Intellectual Property (IP) essentials all founders should be aware of when they start their businesses.

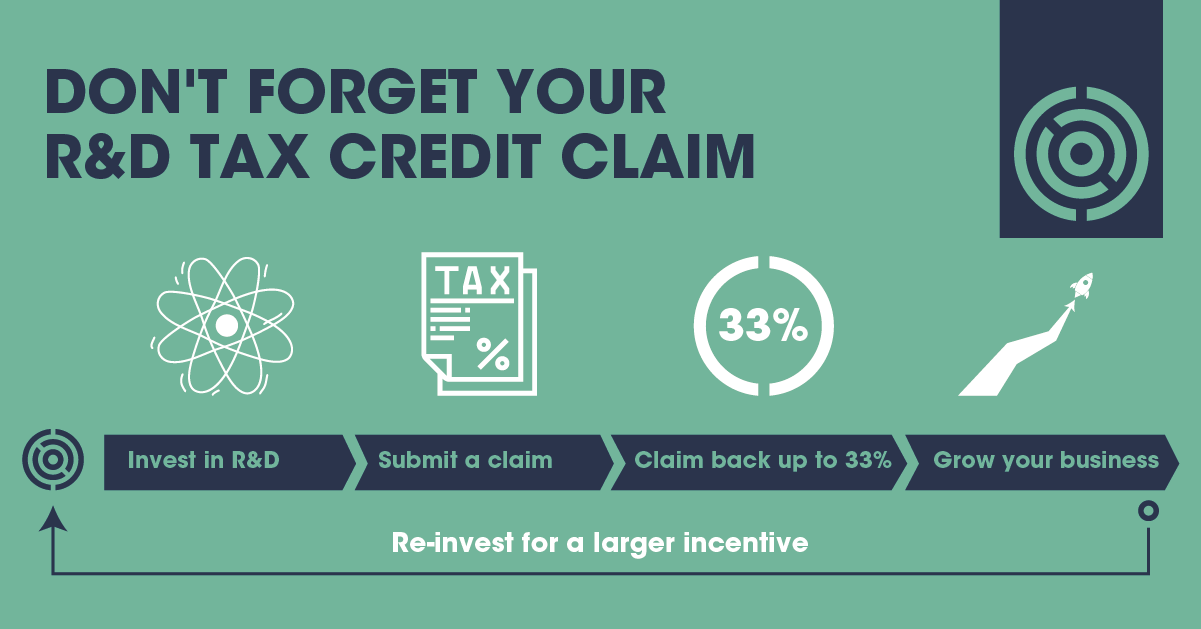

Don't Forget Your R&D Tax Credit Claim

Is your business missing out on a potential vital cash injection? Or could you reduce your corporation tax liability freeing up cash to invest in growth? In this week’s newsletter, we'll also provide a recap on the research and development tax credit essentials every business owner should know.

Solving Founders Budget and Time Constraints

In this week’s newsletter, Dragon Argent take a look at how outsourced financial controller can help founders get expert support in managing their businesses in a way that is cost efficient, flexible and frees up their time - solving several perennial challenges at once!

Venture Capital Investment & Alternatives

In our first newsletter of the year, we're going to take a look at how a company can carry out a valuation for the first time. There are a number of reasons why a founder might want to do this, but primarily for our clients its part of the process of raising equity investment.