Startups and SMEs face many challenges - make sure you know how to overcome them by exploring our blogs for the latest news and insights across a range of accountancy and legal topics.

- (S)EIS Tax Relief

- Accountancy Best Practice

- Art and Luxury Assets

- Business Immigration

- Commercial Law

- Commercial Litigation

- Corporate Law

- Corporate Strategy

- EMI Share Option Scheme

- ESG Compliance

- Employment Law

- Fundraising Strategy

- Human Resources

- Intellectual Property

- Merger and Acquisition

- NFTs and Digital Trading

- R&D Tax Credits

- Startups & SME Advice

- Tax Advice

- UK Subsidiary

Understanding Insolvency: A Comprehensive Guide to Financial Distress and Its Implications

James Phipson explains everything about insolvency in this article: its definition, how it differs from bankruptcy, the role of insolvency practitioners, and its impact on businesses, employees, and sole traders. Find out how to identify if your business is heading towards insolvency.

Understanding the Importance of a Founders’ Agreement

A Founders' Agreement is essential for any startup. Learn why it's crucial for defining roles, responsibilities, and ownership, preventing future conflicts and ensuring your business thrives. Protect your investment today.

Startup Funding Options: Should You Consider Venture Capital?

Turning your innovative idea into a thriving startup requires more than just passion and a good plan. It demands a strategic approach to funding, and understanding the different avenues available is crucial. In this article, James Phipson helps you identify if venture capital (VC) is the right fit for your startup.

Is Venture Capital Right for You? A Guide for Business Owners

Is VC funding right for your business? If you're tackling a huge problem, have a clear edge over competitors, and boast a dream team built for explosive growth, then venture capital might be your key to success In this article, James Phipson dives deep into a checklist for founders to see if VC investment aligns with their vision.

How a Board of Directors can supercharge your startup

Building a high growth entrepreneurial venture? Got your Board of Directors in place? Today's article tackles the burning question: When to form your board of directors, and what are their key responsibilities?

Small Business Aspirations, Big Grants: Your Route to Funding

Small businesses play a crucial role in the UK economy, and small business owners have a significant impact on contributing to its growth and prosperity. In this blog, we will explore the small business landscape in the UK, the various types of grants available, and how Dragon Argent, can help you secure these grants.

Research and Development Tax Relief Changes 2023

From 1 April 2023, there are several changes to the UK R&D scheme to be implemented as a result of the 2021 Budget. We felt it useful to summarise these in this week’s newsletter with some help from our Head of Tax, Misha Patel.

Mergers and Acquisitions Transaction FAQs

In this week’s newsletter Dragon Argent are sharing quick-fire answers to some of the most common questions we receive from business owners when they begin to plan an exit from their company. Typically, these transactions fall into the category of mergers and acquisitions (M&A) and for someone exiting a business, specifically sell side M&A. Our Head of Corporate & Commercial Law, Freddie-Nicole Brace provides the answers.

Investment Round Best Practice

In this week’s newsletter Dragon Argent Commercial Strategy Advisor & Chief Commercial Officer James Taylor had a look at the recent shift in the startup funding landscape that has taken place throughout the first half of 2022. More importantly, we are going to offer some guidance on how founders can insulate themselves from the increasingly challenging environment.

Investment Pitch Deck Presentation Template for Startups & SMEs

In this week’s newsletter, Dragon Argent examines some fundamentals of building pitch decks to raise investment. Certainly, for tech-enabled businesses that are capital intensive, raising investment is an essential aspect of scaling the business.

Workshop Invitation: The Importance of Enterprise Value (EV) and How to Build it

Dragon Argent would like to invite you to attend an online workshop for founders and management teams on "How to Build Enterprise Value".

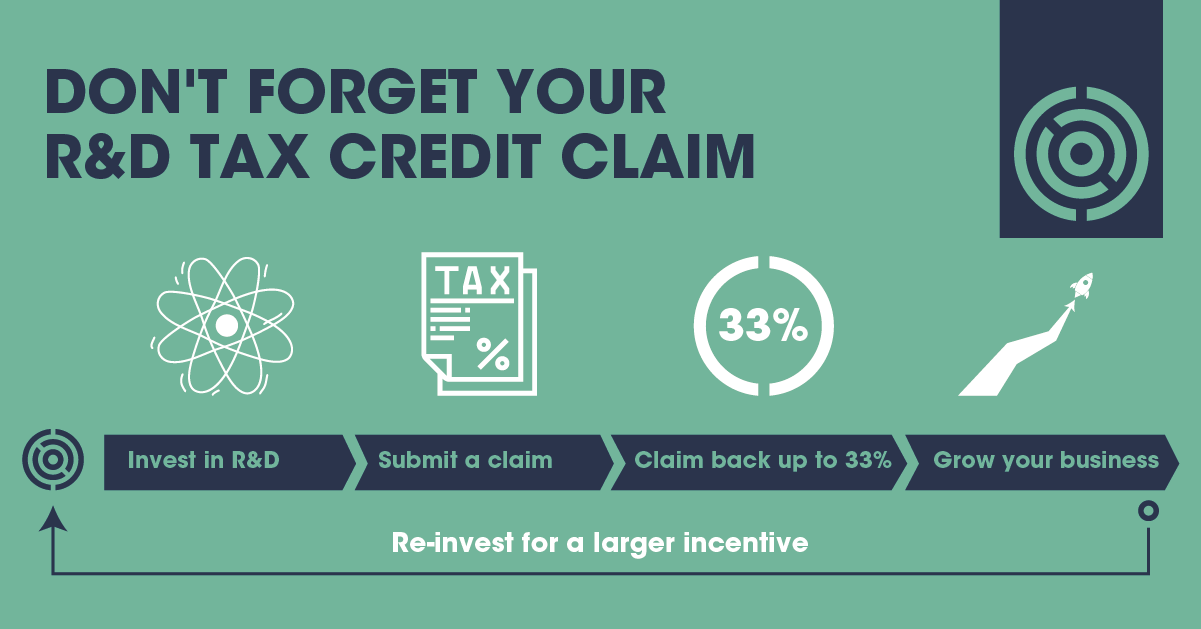

Don't Forget Your R&D Tax Credit Claim

Is your business missing out on a potential vital cash injection? Or could you reduce your corporation tax liability freeing up cash to invest in growth? In this week’s newsletter, we'll also provide a recap on the research and development tax credit essentials every business owner should know.

Venture Capital Investment & Alternatives

In our first newsletter of the year, we're going to take a look at how a company can carry out a valuation for the first time. There are a number of reasons why a founder might want to do this, but primarily for our clients its part of the process of raising equity investment.