Startups and SMEs face many challenges - make sure you know how to overcome them by exploring our blogs for the latest news and insights across a range of accountancy and legal topics.

- (S)EIS Tax Relief

- Accountancy Best Practice

- Art and Luxury Assets

- Business Immigration

- Commercial Law

- Commercial Litigation

- Corporate Law

- Corporate Strategy

- EMI Share Option Scheme

- ESG Compliance

- Employment Law

- Fundraising Strategy

- Human Resources

- Intellectual Property

- Merger and Acquisition

- NFTs and Digital Trading

- R&D Tax Credits

- Startups & SME Advice

- Tax Advice

- UK Subsidiary

Important Tax Deadlines for Employers Explained

In this week’s newsletter, Dragon Argent Tax Advisor, Misha Patel have drawn attention to two tax reporting deadlines which are approaching on July 6th 2022. These are employment related securities reporting and P11D reporting. Learn more.

How to Apply for Business Recovery Loan Scheme?

Are you aware that there are just 3 months left to capitalise on potentially transformative government backed finance? Get funding through accredited RLS lenders. No Personal Guarantees for Loans Below £250k.

Is my business eligible for R&D tax credits

Dragon Argent R&D tax specialists provide an end-to-end service that makes claiming R&D tax credits easy for you. The average UK SME R&D claim is worth £32,409* so don't miss out on the chance for a valuable cash injection for your business. How to claim R&D Tax Credits?

Directors Loan Accounts & How to Use Them

Our specialist accountants for startups look at exactly how a directors loan account functions, what it can help a director to achieve and tax planning opportunities. Learn more

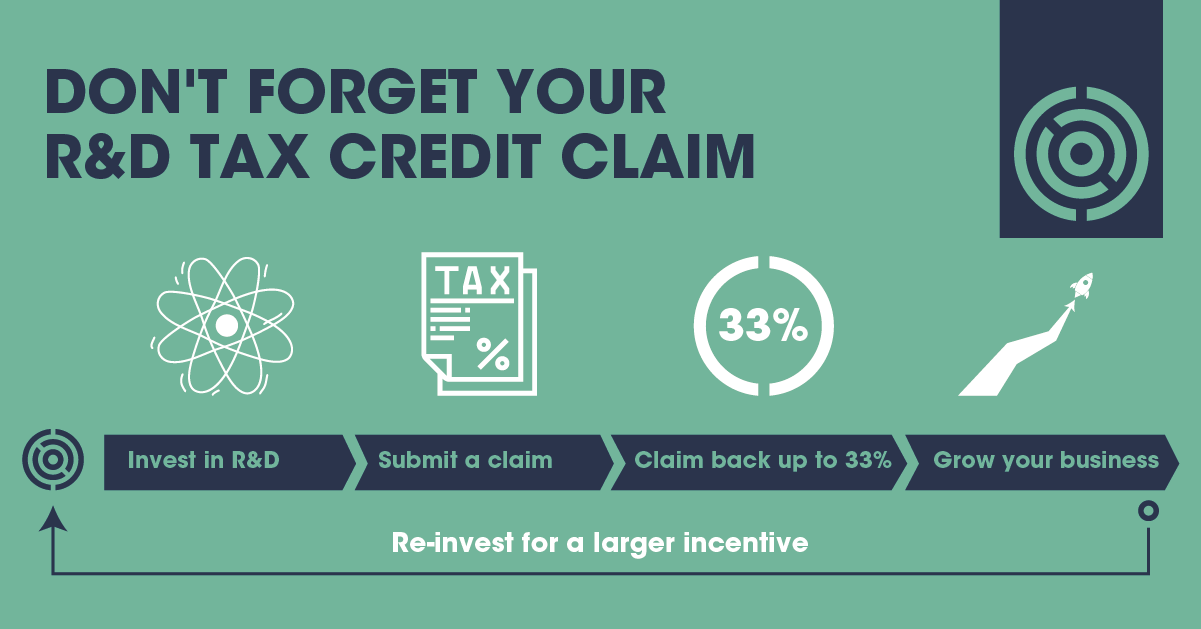

Don't Forget Your R&D Tax Credit Claim

Is your business missing out on a potential vital cash injection? Or could you reduce your corporation tax liability freeing up cash to invest in growth? In this week’s newsletter, we'll also provide a recap on the research and development tax credit essentials every business owner should know.

Fundraising Strategy 2022: For Startups & SMEs

As we enter the tail end of the year, founders and entrepreneurs will be thinking about key objectives for 2022, setting targets and managing their runway. For many, these plans will be reliant on raising new investment. In this week’s newsletter, Dragon Argent are covering a timely reminder of some of the keys to successful raises.

Accounting Tips: Budgeting in Uncertain Times

As we approach the end of 2021, its time to start thinking about the budgeting for next year. In this week’s newsletter, Dragon Argent sharing some budgeting best practice that should help you create robust yet flexible budgets to chart business performance heading into 2022.

SME Advisor: Invitation to the Building Valuable Startups Webinar

Do you spend time considering what factors drive the value of a business? Have you had the opportunity to take a step back from your day to day to think about how to build enterprise value? As a valued member of the Dragon Argent community, we would like to invite you to attend our upcoming webinar – Building Valuable Startups.

R&D Tax Credit Calculator For Startups & SMEs

HMRC estimates that approximately 75% of businesses that could qualify for an R&D tax credit don’t make a claim. If you think your business would qualify and you have eligible costs which you could claim again, use our R&D Tax calculator here to get an estimate of the value of a rebate.

The Importance of Cash Flow Forecasting for Startups

For many startup founders, one of the chief causes for concern is availability of cash – often referred to as runway. Without which they would quickly sink. It’s for this reason that regular, accurate cashflow forecasting is essential – which we are going to take a detailed look at in this week’s newsletter.

Personal Tax Planning Best Practice

The last week of July is the point at which many individuals under self-assessment must make their second payment on account for taxes for the 2020/21 tax year. It therefore feels like an appropriate time to reinforce some personal tax planning best practices,. Learn more.

7 Ways to Maximise Management Accounts

What do all major decisions taken within a business have in common? They are all influenced by the financial health of the company.

What is Research & Development Tax Relief?

Many new businesses spend the first season of their existence researching and developing a concept or a prototype. If any project on which the company works is seeking to making an advance in the fields of science or technology, the costs of that project may be eligible to provide the company with extra tax relief, through its annual corporation tax return.

Budget Policies Plan to Fuel SME Growth

The primary aim of government tax policy is to incentivise certain behaviours and discourage others. Here, Dragon Argent consider three policy announcements from last week’s Budget, that when reviewed together, have significant implications for startups and SMEs and some insight into the government’s strategy for business in the coming years.

The Top 5 Accounting Risks for Startups and SMEs

There are some accounting risks every startup founder and owner operator should be aware of. These risks can not only impact the ongoing viability of a business but also have a detrimental effect at major events such as investment rounds or exit processes. Robust management accounting is fundamental to the enterprise value of a company and will help mitigate accounting surprises such as those outlined below on an ongoing basis or within due diligence.

Spring Budget 2021: What It Means For You

On Wednesday, the Chancellor announced his Spring Budget for 2021. As ever, it was packed with changes to the financial landscape for UK individuals and businesses. Below are some high-level summaries of the key changes. Do get in touch for more detail and specific application to the circumstances you and your business face.

Tax Efficient Share Incentive Schemes

Employee Share Incentive Schemes for UK SMEs allows employer to provide shares to an employee free of tax, provided it meets certain conditions. Government-approved share schemes offer tax benefits to both employers and employees and can offer other advantages to businesses. Learn more.

SEIS and EIS Tax Relief Schemes

When forming a company and putting in place the required legal documentation that supports your company structure, it is worth thinking about the future funding needs of the business. The majority of startups will at some point seek external investment, with the first round of investment typically being referred to as seed or pre-seed funding.

New R&D Tax Credit Cap – April 2021

As part of the forthcoming Finance Bill 2021, HMRC have announced a cap on the amount that a loss-making SME can receive in R&D tax credits to stop abuse of the scheme.

Why Startups Fail

The technology analysts CB Insights have curated some amazingly valuable information over the last 6 years looking at why startups fail. In this time, they have conducted over 350 investigations into startups that failed, identifying the most common reasons.